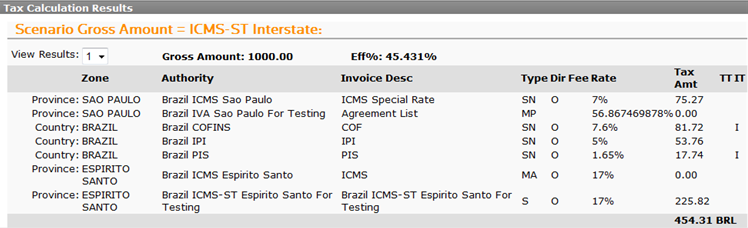

ICMS in Sao Paulo is the highest 7-25 generally it averages 18 and could give you a generalbroad idea of what you would pay in ICMS elsewhere in Brazil. Of the Brazilian Oil Gas industry represents only 3 of what it will After dark times of barrel prices below 40 industry showed it resilience combining leaner operations with efficiency and deep water exploration as Brazilian majority of areas survived decreasing the lifting cost especially in pre-salt areas.

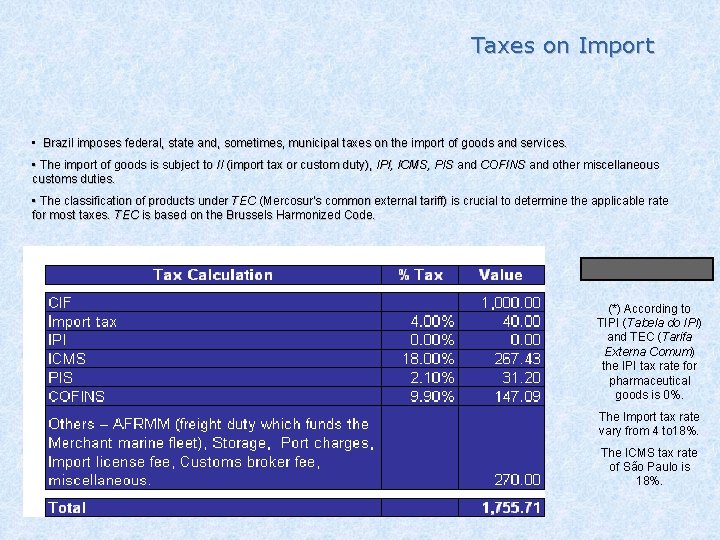

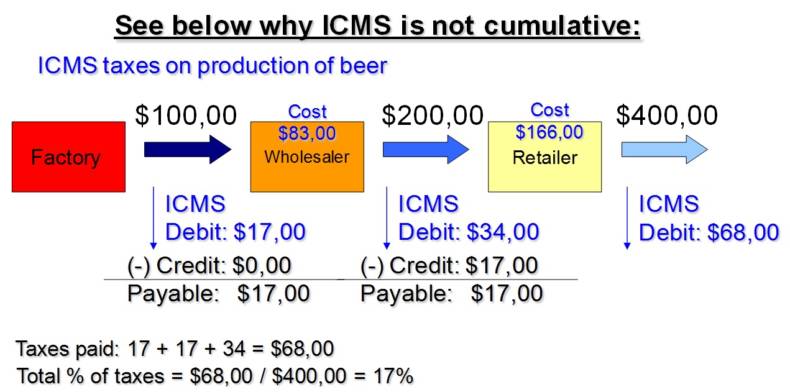

For the supply of several goods the ICMS tax payment is attributed to the importer or manufacturer as responsible for the tax due on operations that will occur subsequently.

Icms brazil definition. International Center for Medical Specialties. Looking for the definition of ICMS. The exclusion of state vat icms from the calculation basis of the federal contributions on total revenue piscofins known as the thesis of the century among lawyers businessmen and the media ended on may 13 2021 when after a succession of postponements the brazilian supreme court stf modulated the effects of the first decision.

ICMS is the abbreviation for Imposto Sobre Operações Relativas à Circulação de Mercadorias e Serviços de Transporte Interestadual de Intermunicipal e de Comunicações. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. This transfer of responsibility for the tax payment is known as the taxpayer substitution regime the taxation in Brazil is based on.

Intelligent Cable Management System NORDXCDT ICMS. Whats your industry or products. ICMS is a State tax and varies depending on your industry and State you are doing business with.

Intelligent Condition Monitoring System. Although belated the definition that the ISS is the tax to be applied is positive for the software industry in Brazil bringing tax and legal certainty for the taxpayers tax savings depending on the concrete situation and more simplicity for businesses in the IT sector. Interpretation on ICMS exclusion of PISCOFINS tax basis.

Integrated Cargo Management System is one option -- get in to view more The Webs largest and most authoritative acronyms and abbreviations resource. A value-added tax in Brazil. Short for Imposto sobre Produtos Industrializados which is Portuguese for Tax on Industrialized Products IPI is a federal tax that is applied to all national and foreign products that have been modified in some industrialized way for consumption or use.

The abbreviation stands for Imposto sobre circulacao de mercadorias e servicos. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE. Launched this July ICMSis a benchmarking and reporting framework for international cost classification reporting and comparison and was developed by more than 40 global standards bodies also known as the ICMSCoalition.

2012 Farlex Inc. Interdepartmental Committee for Meteorological Services. Tax statements in brazil Accounting legal and legal representation consultancy in Brazil for companies in the USA and Europe.

On April 27 2020 the Brazilian Federal Supreme Court STF concluded the judgment of ARE 665134MG which discussed to which state would the state VAT levied on the import of goods ICMS-Import be paid partially settling a long-lasting controversy but leaving out important matters that will remain controversial. Standardised reporting to boost transparency in construction sector. International Case Management System.

Inter Carrier Messaging Service. It is a tax on sales and services and applies to the movement of goods transportation communication services and other general supplying of goods. Whats your industry or products.

Icms The Brazilian Tax On Commerce And Some Services Bpc Partners

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Nt2015 003 Ec87 15 Icms Partition Poverty Fund Sap Blogs

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Icms Tax On The Movement Of Goods And Services On Transportation And Communication Bpc Partners

Brazil Legal Requirements Taxes 10292020 Introduction Main Taxes

Icms Tax On The Movement Of Goods And Services On Transportation And Communication Bpc Partners

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Icms Tax On The Movement Of Goods And Services On Transportation And Communication Bpc Partners

Setting Up The System For Brazilian Taxes

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Nt2015 003 Ec87 15 Icms Partition Poverty Fund Sap Blogs

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Icms The Brazilian Tax On Commerce And Some Services Bpc Partners

Roak Typeface 2013 By Dawid Cmok Via Behance Graffiti Lettering Fonts Graffiti Lettering Lettering Alphabet

Icms Tax On The Movement Of Goods And Services On Transportation And Communication Bpc Partners

Navigating Brazil S Complex Icms And Iss Tax Regulations

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

ConversionConversion EmoticonEmoticon